To determine the best Bitcoin miner, we first need to distinguish the pros and cons of different miners and make informed decisions based on our actual circumstances! This article will cover the following points:

Table of Contents

Toggle1.How to Choose the Right Bitcoin Miner

Faced with a variety of miners, many newcomers may struggle to select the right equipment. Bitcoin miners range in price from hundreds to tens of thousands of dollars, so as blockchain investors, we need to think rationally and make decisions that are valuable based on our own situations.

Let’s start by comparing the three common cooling methods: air-cooled, water-cooled, and oil-cooled miners.

Air-Cooled Miners:

Examples include Antminer S21, T21, and S21 Pro. Air-cooled miners are easily recognizable, typically featuring 1-2 fans at the main body. As the chips generate significant heat during high-intensity operation, these fans will activate to dissipate most of the heat.

Advantages:

- Lower Cost: The overall cost of Antminer air-cooled miners is relatively low, with a reasonable price per T.

- Simple Maintenance: Maintenance is relatively straightforward, primarily focusing on issues like circuit board shorts and controller board failures.

Disadvantages:

- High Noise Levels: In high-temperature environments, fans operate at maximum efficiency, generating considerable noise.

- Average Cooling Effectiveness: When environmental temperatures exceed 35 degrees Celsius, the chips automatically throttle to protect themselves, impacting hash rate output.

Water-Cooled Miners:

Advantages:

- High Cooling Efficiency: Water-cooled miners perform well even in extreme environments, maintaining stable temperatures.

- Longer Lifespan: Water-cooled miners generally have longer lifespans, as the cooling system prevents dust and high temperatures from damaging the chips.

Disadvantages:

- Higher Cost: Water-cooled miners are more expensive, although their price per T is not high.

- Complex Installation: Requires professional electricians to assist with installation, as the system demands 380V three-phase power.

Oil-Cooled Miners:

An example is the S21 Imm, which operates with electronic fluorinated liquid or hydraulic oil.

Advantages:

- Ultimate Cooling: Oil-cooled miners are high-temperature resistant and suitable for overclocking operations.

- Extended Lifespan: Due to maximized cooling, oil-cooled miners tend to have longer lifespans.

Disadvantages:

- Highest Cost: The quality fluorinated liquid required for operation increases costs.

- High Installation and Maintenance Requirements: Requires professional electrician assistance for installation.

.png)

2.Common Bitcoin Miner Manufacturers

Currently, the main manufacturers producing air-cooled, hyd-cooled, and oil-cooled miners are BITMAIN and MICROBT and Canaan

BITMAIN:

Air-Cooled Miners: S21, S21 Pro, S19 KPro series.

Water-Cooled Miners: S21 Hyd, S19 XP Hyd series.

Oil-Cooled Miners: S21 Imm.

MICROBT:

Air-Cooled Miners: M50, M60 series.

Water-Cooled Miners: M53, M63 series.

Oil-Cooled Miners: M56,M66 series.

Canaan:

Air-Cooled Miners: A1366, A1466,A1566

Oil-Cooled Miners: A1466 IMM

It’s worth noting that all air-cooled miners can be retrofitted to water or oil cooling, with HashZebra providing relevant modification tutorials.

3. Currently the Most Profitable 5 Bitcoin Miners

Based on the current Bitcoin price ($90,000) and electricity cost ($0.055 USD/KWH), here are the most profitable miners:

|

Miner Model |

Power |

Hash Rate |

Price/T |

Unit Price |

Daily Cost |

Daily Income |

Payback Period |

|

Antminer S21 XP Hyd |

5676W |

473T |

$22/T |

$10,406 |

$7.49 |

$20.33 |

511.8 days |

|

Antminer S21 Hyd |

5360W |

335T |

$16/T |

$5,360 |

$7.08 |

$12.62 |

424.7 days |

|

Whatsminer M63S |

7215W |

390T |

$17/T |

$6,630 |

$10.39 |

$13.42 |

494.0 days |

|

Antminer S21 XP |

3645W |

270T |

$21.8/T |

$5,886 |

$4.81 |

$11.07 |

531.7 days |

|

Whatsminer M63 |

7323W |

368T |

$15.7/T |

$5,777.6 |

$9.61 |

$11.92 |

484.7 days |

4. Most Cost-Effective 3 Bitcoin Miners

Here are the recommended miners from a cost-effectiveness perspective, primarily based on investment price and payback period:

|

Miner Model |

Power |

Hash Rate |

Price/T |

Unit Price |

Daily Cost |

Daily Income |

Payback Period |

|

Antminer S19K Pro |

2760W |

120T |

$6.8/T |

$816 |

$3.64 |

$3.42 |

238.5 days |

|

Avalon A1466 |

3500W |

153T |

$7.3/T |

$1,116.9 |

$4.62 |

$4.2 |

265.9 days |

|

Antminer S21 Hyd |

5360W |

335T |

$16T |

$5,360 |

$7.08 |

$12.62 |

424.7 days |

5. Conclusion

For short-term investors (under one year), air-cooled miners are a suitable choice since they don’t require long installation or waiting times, allowing faster returns. However, the longer you use an air-cooled miner, the greater the risk of breakdowns. Repaired air-cooled miners also tend to depreciate significantly on the second-hand market.

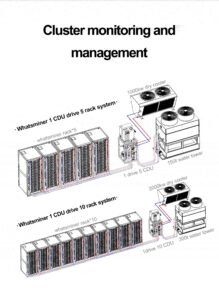

For long-term investors (over one year), water or oil-cooled miners are advisable for greater durability and higher yields. Water-cooled miners offer the advantage of a relatively straightforward installation, with the PLC system automating operations and monitoring. With a dry cooler setup, users need only add small amounts of pure water or glycol monthl